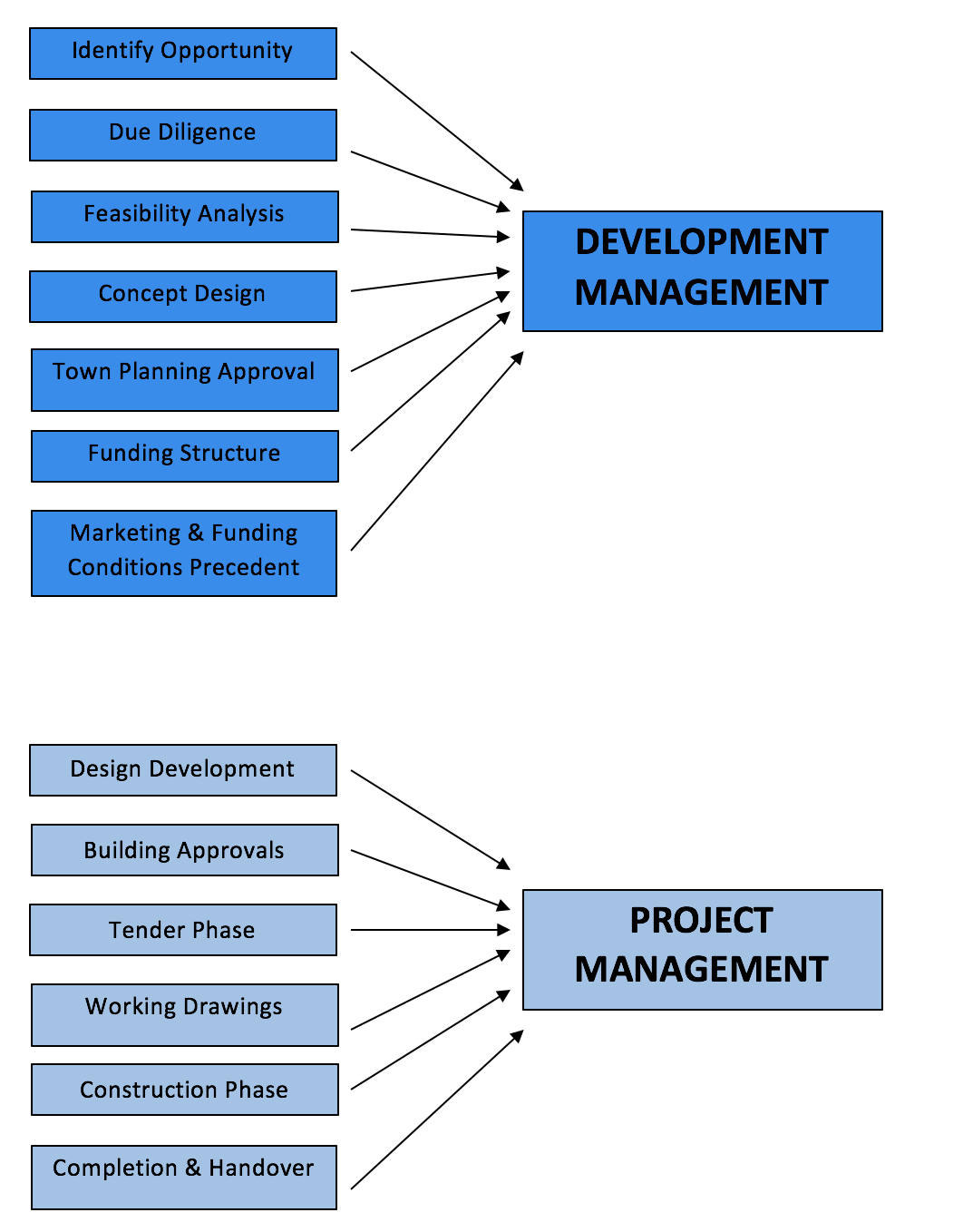

Step 5 is the Building Approval and encompasses the detailed engineering design. The importance of monitoring efficient and timely design in this phase is critical to maintaining projects budgets and program.

Don’t take your eye off the ball now…

Design team protocol and co-ordination

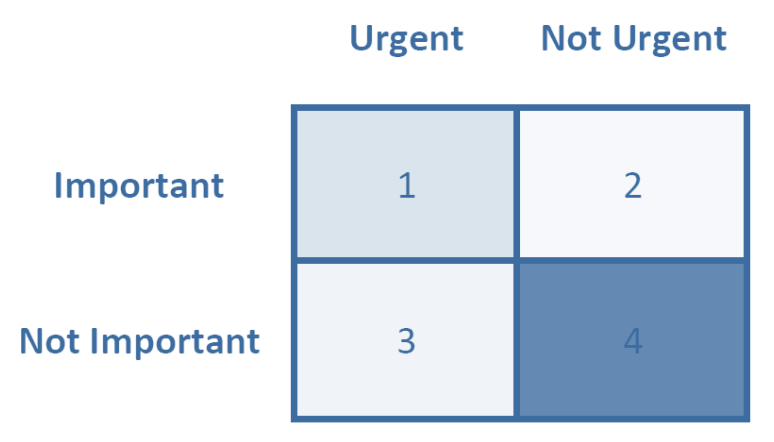

As the Project Manager it is critical that you have a clear protocol around communication during the detailed design phase.

Be clear on who the lead co-ordinating consultant is (it’s amazing how often this gets missed).

Be clear on what decisions require stakeholder engagement.

Have set hold points during detailed design where plans are reviewed for efficiency of design and cost.

Designs need to be measured against project budgets and also against stakeholder expected outcomes (which remember can often be intangible but can be measured against tangible design)

General approvals in the stage will include –

Operational Works (local council)

Compliance Assessment (local council)

Hydraulic approval (local council)

QFES approval (Fire)

Building Approval (Certifier)

You must ensure the original Town Planning Approval (MCU) is reviewed in BA stage, as all conditions of the MCU must be reflected in the detailed design.

This may include Referral Agencies such as environment or main roads, dependent on the nature of the project.